Home

Definitions

Recessions/Depressions

Inflation / Deflation & Fiat Money

Gold & Silver

Charts

Fixing The Problem

Our Current Downturn

Nearterm Outlook

Assets

Real Estate

Stocks

Investing

Links/Experts

Books

Contact

Real Estate

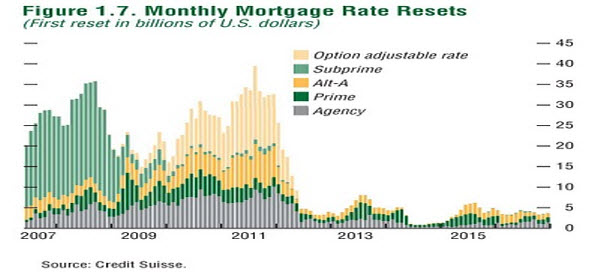

Alt-A / Option-Arm Resets

Above is a reset chart for the various loan types originating during the housing boom of the early 2000's. Note that the default rate for many of these loans types is at least 60%. What's looks to come down the pike is a revisit of the subprime mortgage troubles.

The Different Mortgage Types

- Subprime -Given to individual with poorer credit ratings. Often has a three year reset period after which mortgage payments rose substantially. High default rate.

- Option Adjustable rate (Option ARM) - You can pay a minimal amount towards your mortgage. It's possible to actually go into negative amortization where you owe more on your mortgage after a couple years than the original mortgage. The default rate seems to be around 66%. There is a total of about $500-$600 billion in outstanding Option Arm mortgages.

- Alt-A- A step below Prime and one step above Subprime. There are about a $1 trillion worth of Alt-A loans outstanding. Default rates are very high.

- Agency - Issued by US sponsored agency.

- Prime - Standard 30 year fixed. It's important to note that Prime mortgages are beginning to default in greater quantity and there is the rising incidence of strategic default where people realize they are underwater and decide to simply walk away as an investment decision.

Looking Forward

- Alt-A/Option Arm Resets - Greater than $1 Trillion going through mid 2012 with a default rate of 60% and more.

- Strategic Defaults - People are walking away from underwater prime mortgages in greater numbers.

- End of Obama Tax Credit (4/30/2010).

- 98% of residential loans are originated or backed by Fannie, Freddie, FHA - will this continue and how long can this continue? There is talk of taking Fannie & Freddie into bankruptcy.

- Significant Shadow Inventory of houses that banks are afraid to put on the market.

In summary, there is still significant downward pressures on real estate prices going through at least mid-2012 and probably beyond. The one wildcard is inflation.

Resources For Those In Financial Trouble

Strategic Default (60 Minutes Piece)

05/14/2010