Home

Definitions

Recessions/Depressions

Inflation / Deflation & Fiat Money

Gold & Silver

Charts

Fixing The Problem

Our Current Downturn

Nearterm Outlook

Assets

Real Estate

Stocks

Investing

Links/Experts

Books

Contact

The Current Downturn

According to the NBER, the current downturn began in December of 2007.

Going into 2008, The Great Recession started as a Deflationary Downturn.

The policy of the US government so far has been to actively fight the downturn through monetary policy including:

- TARP, $700 billion

- Fed purchase of $300 billion of long bonds and $800 billion MBS from Fannie/Freddie (march, 2009)

- 0.25% fed funds rates

- Numerous bailouts of companies and institutions - some publicly admitted and others not.

How Long Will the Great Recession Last?

The deflationary process of the 1930's took roughly four years from 1929 to 1933. Unfortunately, due to extenuating circumstances, the depression lasted much longer and had a second downturn in 1937. Depressions function to squeeze out debt, so taking a look at the debt obligations of the US probably gives a good clue as to the length of the outstanding downturn

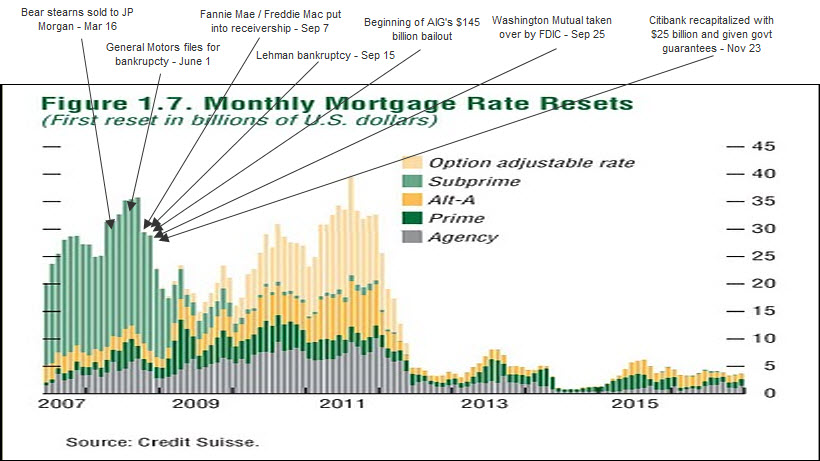

#1 - Residential Real Estate>

#2 Commercial Real Estate

Commercial real estate experienced the same upswing in the early 2000's as residential real estate and was often funded by loans with five year expirations. It's expected that by the end of 2010, roughly 50% of commercial real estate loans are expected to be underwater with Credit Suisse predicting a 70% top to bottom drop in commercial real estate by 2017. Even cash flow positives projects may have difficulty finding refinancing with underfunded lenders.

Is High Inflation / Hyperinflation of the Currency a Possibility?

Yes. After the EU's announcement on May 9th that it would be injecting $1 trillion dollars in the economy, it became evident that both Europe and the US are committed to continued monetary stimulus to combat their problems. What important to note is that hyperinflation is not possible without a government willing to continually print to deal with fiscal problems. The pattern so far has been crisis, stimulus, crisis, stimulus. It's doubtful that the government will take another tack.

If the economy falters soon, the US has tremendous budget deficits that probably will not be filled by foreign purchases of treasuries which mostly like will force the monetization of the debt. Defaulting on government debt is probably something the US is not willing to do, although it may be forced upon the US which will probably precipitate a Currency Crisis.

John Williams of www.shadowstats.com predicts the worst. His report can be read here: Hyperinflationary Special Report.

What about a Currency Crisis?

Inflationary, but not necessarily hyperinflationary (where the currency loses all value). A currency crisis arises when foreigners dump a nation's currency for fear of it's losing value. In 2000, Argentina defaulted on a $95 billion loan which forced a dumping of the Peso by foreigners. The currency pressure became too great and the Argentinean government had to break the 1 to 1 peso/dollar peg which had lasted for ten years. The peso very quickly lost 75% of it's value before the decline was halted.

Because the United States is printing large amounts of money, AND foreigners (especially the Chinese & Japanese) hold large quantities US treasuries, we could have a currency crisis if these countries decide to dump their dollar denominated assets. In fact, what's probably prevented a crisis from already happening is the fact that the dollar is the reserve currency and also the most commonly used currency for international transactions. Irregardless, if the United States continues to print money as it has, a currency crisis may become a very real possibility. Precious metals are protection against this type of economic trouble.

05/13/2010