Home

Definitions

Recessions/Depressions

Inflation / Deflation & Fiat Money

Gold & Silver

Charts

Fixing The Problem

Our Current Downturn

Nearterm Outlook

Assets

Real Estate

Stocks

Investing

Links/Experts

Books

Contact

Inflation, Deflation & Fiat Money

Money

So, what exactly is money? Essentially a good or commodity that is generally exchangeable for other goods or commodities and can be stored for a extended period of time for later use. Good money is portable, durable, divisible, scare, difficult to conterfeit & therefore maintain it's value over time. Money is more efficient in handling the transfer of goods than straight bartering. Historical examples of money:

- sea shells

- tobacco

- cigarettes

- warehouse receipts for product

- copper, iron, silver, gold coins and tokens

- fiat money (paper money)

Fiat Money

If you hunt around this issue long enough you'll eventually come across the term Fiat Money. What is fiat money? The term Fiat comes from Latin and means a command or act of will. Essentially fiat money is simply money created by decree.

Fiat money usually starts on a sound footing as a paper receipt for some other good (iron token, ounce gold, etc). Over time, the issuer of the currency creates more receipts for product than is actually stored in the vaults and breaks the redeemable link of the money. Once the break happens, the paper money has now become fiat money - money simply created by the will of issuer or government.

Inflation

The original meaning of inflation was an increase in the supply of money. If you have X units of money in circulation and you add Y more, you'd have an inflation of (X + Y) / X. Inflation is a general terms that covers all forms of money: gold coins, silver coins, paper money, even sea shells. What makes inflation troublesome is that it devalues the purchasing power of existing money. Stories exist of Portuguese trading ships in the Indian ocean filled to the brim with seashells arriving in ports in Africa to trade for goods. Eventually, the Portuguese flooded the Indian ocean markets with so many seashells that the they simply lost their value as money for the locals.

In many ways, what determines the value of a money is the effort required to create or aquire it. Gold costs roughly about $500/ounce to mine which at $15/hour for labor would be 33 hours of labor per ounce. If you exchange something for an ounce of gold, you now hold something of significant value which is difficult to recreate.

When a currency is essentially a warehouse receipt for an underlying commodity, it basically maintains the same value as that item. When a dollar was fixed at $25/gold ounce, you could actually walk in to a bank and exchange x number of dollars for y ounces of gold. The trouble always comes when the issuer of the currency prints more currency than is redeamable in physical. As the new money makes it way into circulation, prices will begin to rise and often the issuer will often be unwilling to redeem the currency for the asset.

Fractional Reserve Banking

Let's take a quick detour before we cover the next topic of deflation. Two of the primary causes of inflation are government money printing and fractional reserve banking. Fractional reserve banking is a banking style inherited from the goldsmiths of Europe that allows an institution to lend out more money than it actually has on hand. In the days of old, goldsmiths would take gold deposits from individuals and store them in a vault and grant a receipt for later retrieval. The goldsmiths realized over time that not everybody came asking for their gold all at once, so they could lend out a certain portion of that gold and still remain solvent - so after receiving 100 ounces of gold, they might have lend out 80 ounces while keeping 20 ounces on hand. The goldsmiths made money on the lent gold and even began paying interest on deposits to attrach more of the metal. Modern banking has inherited this business style of the goldsmiths. A person deposits a certain amount of money - say $100 - into a bank. The bank keeps $20 on hand as a reserve in case the depositor comes looking for money and lends out the remaining amount of $80.

The reason fractional reserve banking is inflationary is that the $80 the bank lends to individuals and institutions can be deposited in another bank which can then theoretically lend $64 out again (assuming a 20% reserve policy). 80% of the $64 can theoretically be lent again and the process repeats. This process is a called the money multiplier effect and can greatly increase the amount of money in circulation. This process has become even more inflationary in modern times in that debt (i.e. - mortgages & treasuries, not just money) can be used as reserves, thus allowing an even greater amount of overall lending.

Deflation

Well, if you can have inflation, it's also possible to have it's opposite Deflation. Deflations can be voluntary or involuntary, and are historically rare. An example of a voluntary deflation was the decision of the US Government, after the civil war, to reduce the number of greenbacks in circulation from $450,000,000 to $346,681,016 (the government had originally planned to remove more, but found the deflationary forces proved too much for the economy). The deflation of the 1930's was completely involuntary and resulted from the large number of bank bankruptcies that swept the nation. The bankruptcy of a bank essentially extinguishes money which decreases the number of dollars in circulation with a decline in prices following. Japan also went through a deep deflation during the 1990's after it's real estate and stock market bust. Modern deflations are almost always caused by the process of bankruptcies and write downs from debt default.

How Has The Dollar Fared?

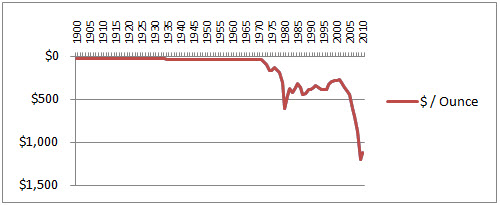

Pretty good until the United States went off the gold standard in 1971:

|

|

|

| US Dollar vs. Gold | US Dollar vs. Gold (Inverted) |

As the graph to the left shows, we've had significant inflation since the 70's with the value of the dollar losing more than 95% since going off the gold standard. Click the following link to see graphs of Chinese first four paper currencies - Graphs of Chinese Currency Depreciation. It's helpful to compare these graphs with the graphs of the dollar above.

Is the United States Currently in a Deflationary or Inflationary Trend?

The 2000's were a highly inflationary time caused by extreme credit growth concentrated, to a great deal, in real estate. This tide turned briefly to deflation in 2008 as the credit bubble popped and a number of bankruptcies ensued (Indymac, Bear Stearns, Lehman, etc.). The tide turned once again to inflation through the massive monetary intervention of the government in the economy - Bernanke is an avowed foe of deflation. Below is a graph of this government intercession:

Surprisingly, even with all this massive government intervention, we've seen only slight signs of price inflation - to a small extend in real estate, food and energy. The forces of deflation will resume once again with a vengeance in the later half of 2010 and into 2011. So far, the government's policy has been to actively combat the deflation through stimulus programs and monetary policy. It's difficult to predict the future, but there's a good chance we'll see a combination of deflation and inflation as the government continues to fight the underlying deflation. Down the road, there's chance of a panicked monetary policy of that could lead to a hyperinflation of the currency.

John Williams of shadowstats.com predicts the worst: http://www.shadowstats.com/article/hyperinflation-2010

The folks over at National Inflation Association have made it their mission to keep track of this issue. Please check them out.

Additional Sources

- "Fiat Paper Money - The History And Evolution of Our Currency" - Ralph T. Foster

- "What Has The Government Done to Our Money?" - Murray N. Rothbard

- "Gold, The Once And Future Money" - Nathan Lewis

- National Inflation Association - http://inflation.us

05/15/2010